reverse sales tax calculator florida

View listing photos review sales history and use our detailed real estate filters to find the perfect place. This script calculates the Before Tax Price and the Tax Value being charged.

Reverse Sales Tax Calculator De Calculator Accounting Portal

Calculate a simple single sales tax and a total based on the entered tax percentage.

. If you buy a taxable item in Florida. Reverse Sales Tax Calculator Remove Tax. Formula s to Calculate Reverse Sales Tax.

According to the Tax Foundation the average sales tax rate in Florida is 701 23rd-highest in the country. The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. Denotes required field Calculate.

The second script is the reverse of the first. Thus you can compute the actual price and the sales tax charged on it out of a products post-tax priceThe formula for computing the actual sales price is easy. This script calculates the Before Tax Price and the Tax Value being charged.

Reverse Sales Tax Computation Formula. Instead of using a reverse Sales Tax Calculator you can divide the final items price by 1 total Sales Tax. Here is how the total is calculated before sales tax.

Sales Tax Calculator Reverse Sales Tax Calculator. Property Information Property State. Florida Washington Tennessee and Texas all generate more than 50 percent of their tax revenue from.

See the article. How to Complete the Back of Your DR-15EZ Sales and Use Tax Return Exercise 1 Exercise 2 Exercise 3 DR-15EZ Summary How to Calculate Collect and Report Your Discretionary Sales Surtax. Amount without sales tax QST rate QST amount.

Please check the value of Sales Tax in other sources to ensure that it is the correct value. That entry would be 0775 for the percentage. For State Use and Local Taxes use State and Local Sales Tax Calculator.

Additionally some counties also collect their own sales taxes of up to 15 which means that actual rates paid in Florida may be as high as 75. Input the Tax Rate. Calculate Reverse Sales Tax.

This tool can calculate the transferexcise taxes for a sale or reverse the calculation to estimate the sales price. Input the Tax Rate. Adjustable Rate Mortgage Calculator.

Before-tax price sale tax rate and final or after-tax price. You can calculate the Sales Tax amount you paid employing any reverse Sales Tax Calculator sometimes called the Sales Tax deduction calculator or using a simple formula. To find the original price of an item you need this formula.

Press enter to return to the slide. Florida has a 6 statewide sales tax rate but also has 367 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1037 on top. Input the Final Price Including Tax price plus tax added on.

The statewide sales tax rate in Florida is 6. Zillow has 1606 homes for sale. Please check the value of Sales Tax in other sources to ensure that it is the correct value.

Current HST GST and PST rates table of 2022. The formula looks like this. There are times when you may want to find out the original price of the items youve purchased before tax.

4 on amusement machine receipts 55 on the lease or license of commercial real property and 695 on electricity. Net Price is the tag price or list price before any sales taxes are applied. Welcome to the TransferExcise Tax Calculator.

Total Price is the final amount paid including sales tax. We can not guarantee its accuracy. Floridas general state sales tax rate is 6 with the following exceptions.

Tax rate for all canadian remain the same as in 2017. Use tax is due on the use or consumption of taxable goods or services when sales tax was not paid at the time of purchase. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

Input the Final Price Including Tax price plus tax added on. If you know the total sales price and the sales tax percentage it will calculate the base price before taxes and. Sales TaxPrice Before TaxPrice After Tax025050075010001250.

Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. Enter the sales tax percentage. For instance in Palm Springs California the total sales tax percentage including state county and local taxes is 7 and 34 percent.

PRETAX PRICE POSTTAX PRICE 1 TAX RATE. Amount without sales tax GST rate GST amount. Pre Tax Price of Product Sale Price Post Tax Price 1 TAX RATE.

On March 23 2017 the Saskatchewan PST as raised from 5 to 6. 52 rows This reverse sales tax calculator will calculate your pre-tax price or amount for you. We can not guarantee its accuracy.

Instead of using the reverse sales tax calculator you can compute this manually. Reverse Sales Tax Calculator. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Florida local counties cities and special taxation districts.

Reverse Sales Tax Calculator Remove Tax. OP with sales tax OP tax rate in decimal form 1.

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Calculator With Sales Tax Sale Online 58 Off Www Vetyvet Com

How To Pay Sales Tax For Small Business 6 Step Guide Chart

Reverse Sales Tax Calculator 100 Free Calculators Io

Reverse Sales Tax Calculator 100 Free Calculators Io

Kentucky Sales Tax Calculator Reverse Sales Dremployee

Us Sales Tax Calculator Reverse Sales Dremployee

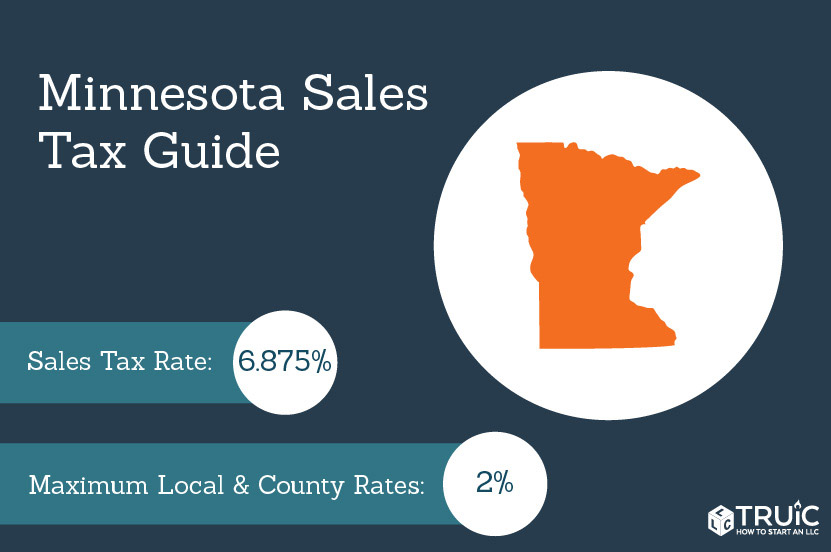

Minnesota Sales Tax Small Business Guide Truic

Avalara Tax Changes 2022 Read This Now Thank Us Later